Play the best casinos

Choosing the right crypto exchange that meets your needs as an investor is an essential aspect of investing in cryptocurrencies. Whether you require easy liquidity, low trading fees, a wide variety of tradable assets, or a user-friendly mobile trading experience, you can find an exchange that fits the bill.< https://kapturem.com /p>

What’s more, Coinbase also offers crypto storage options. The first is a custodial option for new investors: storing your coins on the Coinbase.com exchange. The second is a non-custodial wallet (Coinbase Wallet) for experienced crypto users. When storing your crypto on Coinbase.com, Coinbase holds the private keys and effectively stores funds on behalf of Coinbase.com users. With Coinbase Wallet, the user has complete control over their funds as they hold the wallet’s private keys.

Cryptocurrency investors who use the instant buy feature will incur a charge for the service. The fee will vary depending on the funding method, market conditions, order size, and asset type. When ready to execute the trade, investors will find the fee included in the pricing.

In addition to offering a large number of supported assets, Crypto.com provides a vast digital asset ecosystem composed of its own blockchain, Crypto.org Chain; a native token called CRO; a crypto visa card; yield-generating crypto products; and more.

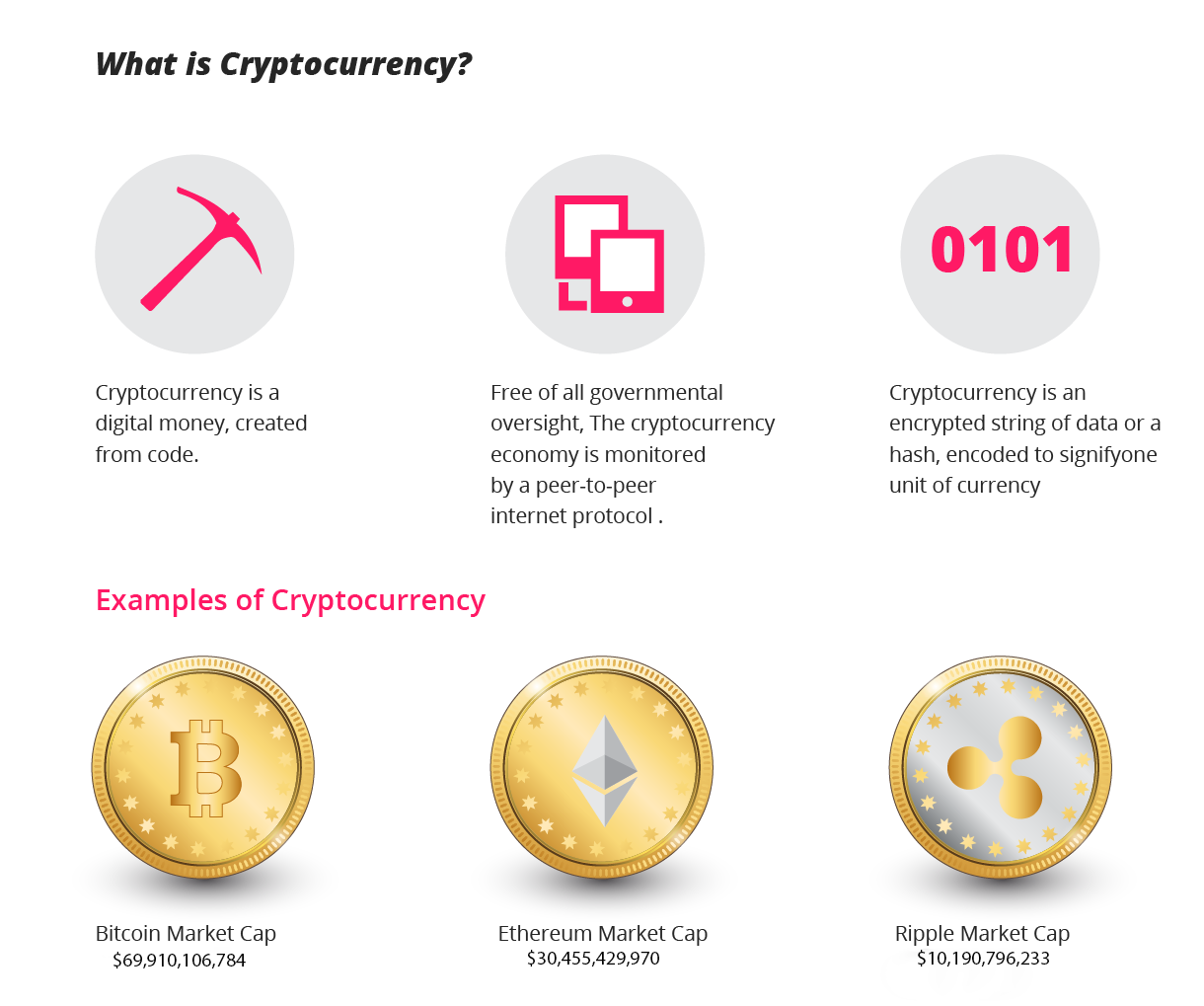

What is cryptocurrency

The European Commission published a digital finance strategy in September 2020. This included a draft regulation on Markets in Crypto-Assets (MiCA), which aimed to provide a comprehensive regulatory framework for digital assets in the EU.

In June 2021, El Salvador became the first country to accept bitcoin as legal tender, after the Legislative Assembly had voted 62–22 to pass a bill submitted by President Nayib Bukele classifying the cryptocurrency as such.

The remittance economy is testing one of cryptocurrency’s most prominent use cases. Cryptocurrencies such as Bitcoin serve as intermediate currencies to streamline money transfers across borders. Thus, a fiat currency is converted to Bitcoin (or another cryptocurrency), transferred across borders, and subsequently converted to the destination fiat currency without third-party involvement.

The European Commission published a digital finance strategy in September 2020. This included a draft regulation on Markets in Crypto-Assets (MiCA), which aimed to provide a comprehensive regulatory framework for digital assets in the EU.

In June 2021, El Salvador became the first country to accept bitcoin as legal tender, after the Legislative Assembly had voted 62–22 to pass a bill submitted by President Nayib Bukele classifying the cryptocurrency as such.

The remittance economy is testing one of cryptocurrency’s most prominent use cases. Cryptocurrencies such as Bitcoin serve as intermediate currencies to streamline money transfers across borders. Thus, a fiat currency is converted to Bitcoin (or another cryptocurrency), transferred across borders, and subsequently converted to the destination fiat currency without third-party involvement.

Cryptocurrencies

In May 2018, Bitcoin Gold had its transactions hijacked and abused by unknown hackers. Exchanges lost an estimated $18m and bitcoin Gold was delisted from Bittrex after it refused to pay its share of the damages.

On 6 August 2014, the UK announced its Treasury had commissioned a study of cryptocurrencies and what role, if any, they could play in the UK economy. The study was also to report on whether regulation should be considered. Its final report was published in 2018, and it issued a consultation on cryptoassets and stablecoins in January 2021.

In 2021, 17 states in the US passed laws and resolutions concerning cryptocurrency regulation. This led the Securities and Exchange Commission to start considering what steps to take. On 8 July 2021, Senator Elizabeth Warren, part of the Senate Banking Committee, wrote to the chairman of the SEC and demanded answers on cryptocurrency regulation due to the increase in cryptocurrency exchange use and the danger this posed to consumers. On 5 August 2021, the chairman, Gary Gensler, responded to Warren’s letter and called for legislation focused on “crypto trading, lending and DeFi platforms,” because of how vulnerable investors could be when they traded on crypto trading platforms without a broker. He also argued that many tokens in the crypto market may be unregistered securities without required disclosures or market oversight. Additionally, Gensler did not hold back in his criticism of stablecoins. These tokens, which are pegged to the value of fiat currencies, may allow individuals to bypass important public policy goals related to traditional banking and financial systems, such as anti-money laundering, tax compliance, and sanctions.

How does cryptocurrency work

While you can hold traditional currency in a bank or financial institution, you store cryptocurrencies in a digital wallet. Banks insure money kept in bank accounts against loss, while crypto has no recourse in the event of a loss.

The short and easy answer to the title question is that cryptocurrencies are decentralized digital assets that you can acquire and trade on designated exchanges, such as Binance, Coinbase, or Kraken. But what exactly does that mean, and how do they work?

Cryptocurrencies are known for their price volatility, which can lead to significant gains, but also substantial losses. This volatility can be a barrier to their use as a stable medium of exchange and store of value.

Bitcoin is the world’s first widely accepted form of cryptocurrency. Bitcoin is so popular, there was a time when its name was synonymous with cryptocurrency. But potential investors need to know bitcoins have become very expensive. In 2021, the cost of one Bitcoin was $68,000. But the good news is, you don’t always have to buy an entire coin, you can buy smaller fractions of it.

Mining is the term used to describe the process of creating cryptocurrency. Crypto transactions need to be validated, and mining performs the validation and creates new cryptocurrency. Mining uses specialized hardware and software to add transactions to the blockchain.